TAXING TIMES AHEAD

STRESSFUL: Families are in for pain

Image: File

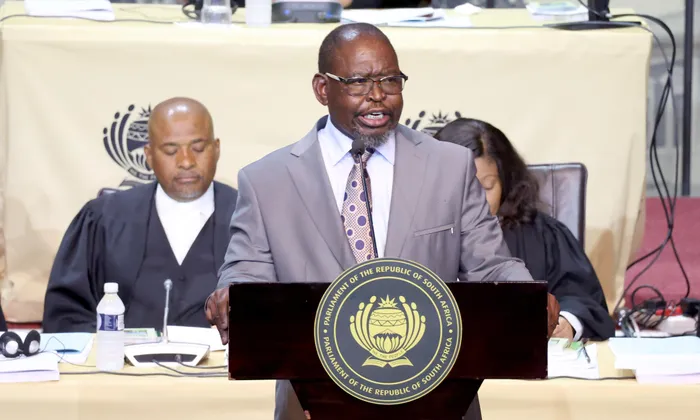

Last week, after two failed attempts, SA Finance Minister Enoch Godongwana delivered the third budget for the year. But does it even really matter to ordinary citizens?

While many South Africans breathed a sigh of relief at the announcement that the proposed VAT increase had officially been scrapped, the actual cost of this budget might not be as comforting as it seems.

Sebastien Alexanderson, Head of National Debt Advisors, says that consumers should look beyond the headlines.

No VAT increase sounds like a win, but households are still struggling, and will continue to do so.

Government might have scrapped the VAT hike, but they need to make up for it in other ways.

The main one is the Fuel Levy hike.

Starting 4 June 2025, fuel levies will increase by 16 cents per litre for petrol and 15 cents for diesel, ending a three-year freeze.

With total fuel taxes now accounting for 30 to 33% of the pump price, this directly impacts transport costs, which in turn affect the prices of food and goods.

Then there is the more shady bracket creep.

Personal income tax brackets have been left unadjusted for inflation, which means that even if you didn’t get a raise, you could be taxed more.

Known as “bracket creep,” this silent tax increase reduces your real income without changing the tax rate.

People might not feel it immediately, but over the next few months, the rise in fuel costs and the bracket creep will slowly erode their purchasing power.

That isn’t good, especially on the working class who are already barely making ends meet.

It’s not just about what you pay at the till. It’s about your rent, your transport, your grocery bill - all creeping up while your salary stays the same.

Here, are some tips for consumers after the budget speech

Budget for Rising Transport and Food Costs: With the fuel levy increase taking effect next month, transport and delivery costs will rise - impacting food and everyday goods. Adjust your monthly budget to account for higher prices.

Check Your Payslip: Even if your salary hasn’t increased, you could end up paying more tax due to unadjusted income brackets. Review your payslip and consider consulting a tax professional to understand your take-home pay better.

Track Your Spending Closely: As indirect costs climb, it’s more important than ever to monitor your daily expenses. Use budgeting apps or spreadsheets to stay in control of your money and avoid overspending.

Avoid New Debt Unless Necessary: With interest rates still high and inflation eating into your income, taking on new debt can worsen your financial position. Focus on managing existing debt and building a small emergency buffer if possible.

Many South Africans don’t really care about the National Budget, the Minister who gave the speech or what the highly paid politicians think about it.

They are just out there working, hustling and living from hand to mouth. Millions are barely surviving on social grants.

Sadly, the mental health of many South Africans is affected by their finances.

The South African Depression and Anxiety Group’s 2025 report documents the connection between debt and mental health: 68% of severely indebted South Africans show clinical anxiety or depression.

As a result, financial distress helplines receive over 300 calls daily.

The Medical Research Council Public Health Reports indicate:

Hospital admissions for stress-related illnesses rose 14% year-on-year

Suicide rates related to financial distress increased by 23% since 2021

Domestic violence incidents are 34% higher in households experiencing severe debt stress.

Please don’t feel alone in your financial struggles. Know that there are many people in the same situation. Speak to your creditors, speak to a registered debt counsellor – or even just to a trusted family member or friend. There should be no guilt or shame in a bad financial situation.

MAN WITH A PLAN: Finance Minister Enoch Godongwana

Image: Phando Jikelo / GCIS

RISING COSTS: Mense are struggling for basics

Image: AYANDA NDAMANE / Independent Newspapers.