Rek Jou Cheque: Bank fraudsters cleaned out my account

Some FNB business customers have been scratching their heads after receiving a warning from the bank about surcharging. Picture: Nadine Hutton/Bloomberg/African News Agency (ANA)

Welcome to the first column of January 2024!

Actually, last week was January. This week is January Lite. Next week will be January Pro, and the last week of the month will be January Ultimate.

May the best debit orders win. This is a long month.

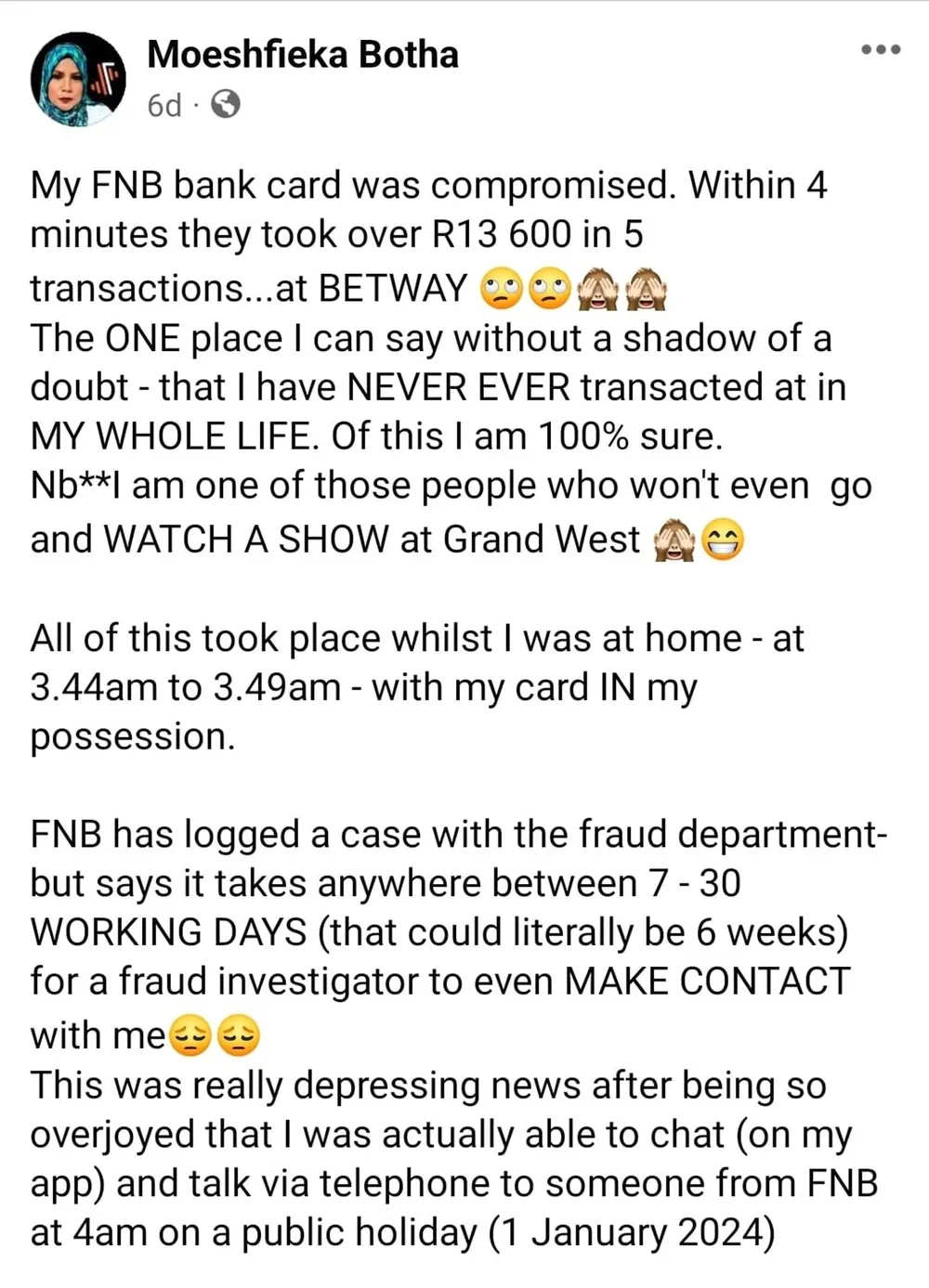

Every year, without fail, Janu-worry hits hard. However, this year has been especially terrible for me. I was the victim of fraud in the early hours of 1 January 2024.

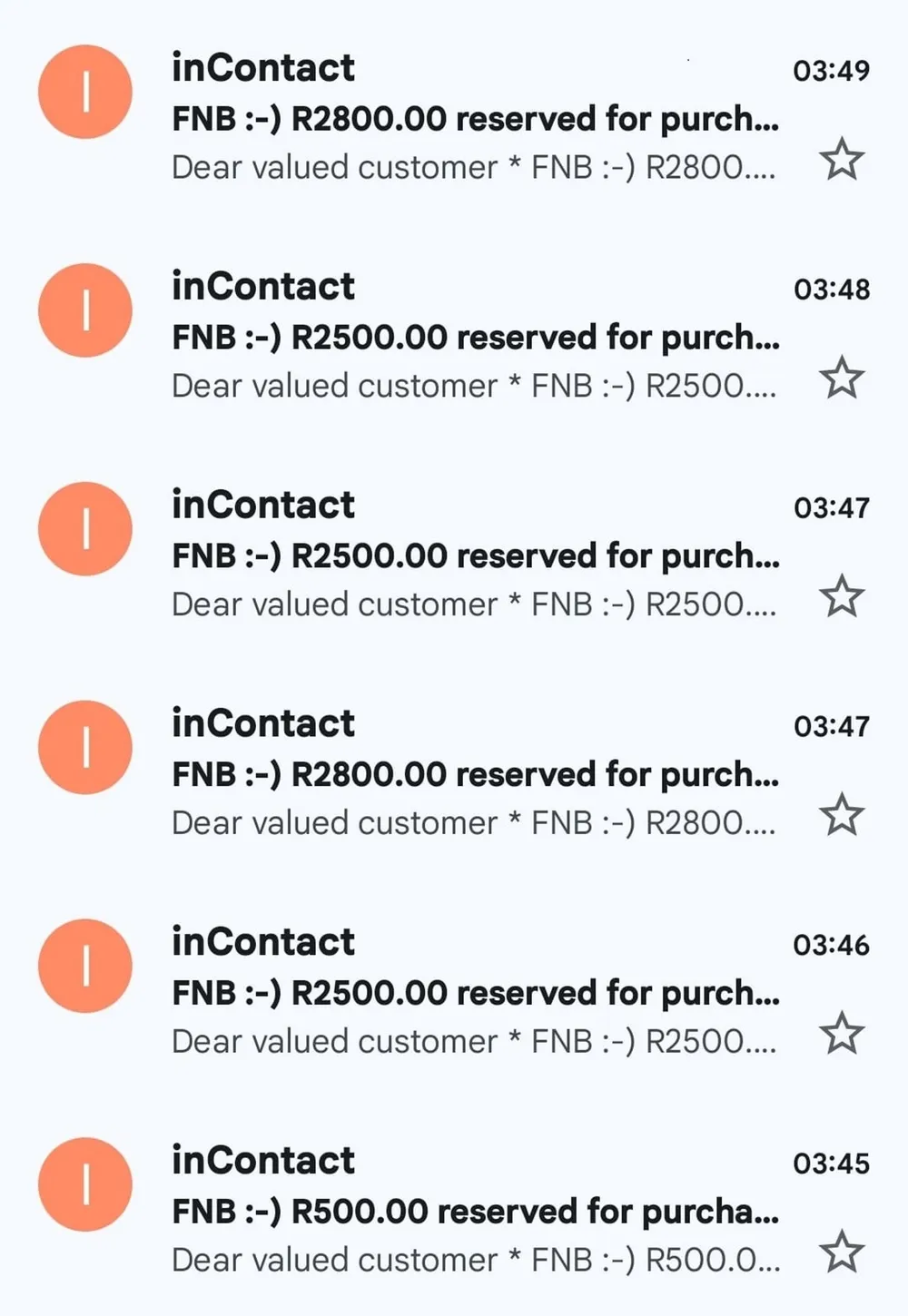

Between 3.45 am and 3.49 am, my FNB credit card account was debited 5 times to the value of R13 600 – while I had my cards, my ID, and my phone in my hand.

I cannot begin to describe to you what I felt as I saw these transactions going off on my account. It was surreal.

I cancelled my cards within 5 minutes of the first fraudulent transaction and immediately contacted FNB via my banking app and told them that because it was 4 am on a public holiday (1 January 2024), I didn’t expect them to get back to me until the next working day, but I was informing them of what had happened.

To my surprise, they were online and even got their fraud department to call me back.

The consultant opened a case and gave me a reference number.

She was very helpful, calm, and friendly at 4am, while I was having a mini–breakdown.

To say that I was impressed with FNB is an understatement.

Sadly, that feeling didn’t last long when she told me that it could take 7 to 30 working days for someone from the investigations department just to make contact with me – much less resolve my query and refund the money.

I understand that cyber fraud is at an all–time high during the festive season, and they have a lot of cases to see to, but I cannot wait 30 working days to be contacted.

Later in the morning, I posted on Facebook, asking if anyone else had experienced this with their banks and what the outcomes were.

The responses blew me away. This was not isolated to FNB.

Customers from all banks have experienced this problem, but it seems that this does happen regularly with FNB.

Here are some of the comments I received on Facebook regarding FNB:

- Happened to me. Card was cloned somehow. Jumped through the hoops with FNB. Refunded after about two months.

- Took FNB about two months to refund me in full. No one made contact with me. I just saw the transactions on my banking app, fully refunded.

- It happened to me also with FNB. It was at an ATM. Within five minutes, R6000 was withdrawn from my account. My limit is R2000. Was a Sunday. Blocked my card. Went in the Monday. Long story short, it took three months to get my money back.

- Happened to me. I reported it. It took so long to get sorted but closed my FNB (account).n

- Happened to me as well. Whilst I was in possession of my FNB card when transactions were made for games, I called in when I received the (messages). Holding on the line and being transferred from pillar to post, whilst three more transactions went off. I have not heard a word from them since Feb 2022. I have called in a few times and my calls were dropped. I went to the bank a month ago and they called the fraud department. I was holding on the line for about 20 minutes and eventually I dropped the call because I was holding on for so long. So for 22 months I have not had a call or message from FNB since the day I logged and received the ref numbered. And yes, I’m close to closing my account. To be fair, there were positive comments too about how FNB dealt with these matters.

- Happened to me with FNB. Same process called the fraud department and they blocked my card and logged a case. I gave them seven working days and followed up and they said it is still being investigated, gave them another seven days and called again and then the guy asked me if I received an SMS with any links to enter my banking details and whether I entered it and I said no and then he said my money will be refunded and within the next 24 hours all the transactions was refund back to my account.

- This happened to me too. Woke up one Sunday morning and multiple transactions went off of large amounts. And it never took that long for FNB fraud department to figure that out and reimburse me. It was less than two weeks and I got it all back

- FNB is quick. My money was returned in four days. Being festive season may cause a delay, I like banking with FNB (I think their banking app is really good and user friendly) and really don’t want to go through the absolute trauma of switching banks, so I hope I get contacted and sorted soon. That being said, if this is happening at all banks, where is our money really safe?

Thank you for allowing me to use the first edition of this weekly financial education column to tell my own story.

I think it’s important to show that this can happen to anyone.

I am looking forward to some very exciting columns and videos this year, which will hopefully make us all more financially savvy and, ultimately, more financially secure.

Please share with us if this has happened to you (with any bank), and if and how it was resolved.

Hit me up on Facebook at Moeshfieka Botha.